Despite five years of Nassau budget surpluses, NIFA still won't give up control

Once created, does any governmental agency ever go away?

Not in Nassau, it seems. Not the Nassau "Interim" Finance Authority, even though"interim" means temporary, not permanent.

The Nassau Interim Finance Authority was created by the state in 2000 to provide financial oversight to Nassau County, which had a history of careening from one fiscal crisis to another despite being one of the wealthiest suburbs in America.

NIFA turned itself into a control board in 2011 when it projected a $176 million deficit in the county's operating budget that year. The state law that created NIFA said a control period can be triggered by a one percent deficit. As a control board, NIFA can dictate and approve all spending.

Although the county ended the last four years with large multi-million dollar surpluses and experts predict another large surplus by the end of this year, NIFA still sees precarious finances in Nassau's future.

In a report released last week, NIFA grudgingly acknowledges the county will end this year with a surplus, but projected trouble ahead:

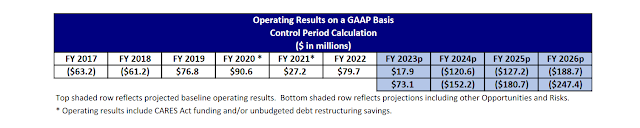

The reports says: "Nevertheless, although we are projecting a potential surplus of between $17.9 million and $73.1 million in FY 2023, we are also projecting sizeable deficits in the Out-Years that could reach between $188.7 million and $247.4 million by FY 2026, as shown the following table.

For the past 23 years, NIFA has always seen deficits in the out years, but its forecasts never seem to match reality when those years arrive.Of course, this NIFA forecast justifies the seven-member unpaid appointed board -- mostly Democrats -- will remain in control of the county, run by elected Republicans.

"Our projected deficits exceed the one percent threshold for imposing a Control Period in each of the Out-Years," the report says.

Before NIFA released its report, county officials expressed hope that NIFA would finally give up control.

"The county is probably in the best fiscal condition it has been in many years," Budget Director Andrew Persich told members of the legislature's Budget Review Committee last Monday, hoping "our friends at NIFA go away."

County Comptroller Elaine Phillips has repeatedly called for NIFA to end its control period. Last week, she did it again, saying Nassau no longer meets any of the five triggers in state law that allow NIFA to take control.

"Nassau county does not meet any of the five stipulations, " she said. "In fact according to NIFA's own calculation, Nassau had a $76.8 million surplus in 2019, $90.6 million in 2020, $27.2 million in 2021 and $79.7 million in 2022."

Phillips added, "I say this truly respectfully....It is time to let Nassau County out of control."

Persich, in response to a question from Legis. John Ferretti, (R-Levittown), said NIFA can rely on forecasts rather than reality in making the call for control.

"They can be wrong every year and still maintain a control period," Ferretti complained.

Maybe the NIFA staff who wrote the report want to maintain their comfortable jobs. Who would have thought 23 years ago that taking a job with an "interim" agency would last more than two decades.

General Counsel Jeremy Wise and Executive Director Evan Cohen have been with NIFA since it started.

As of last year, each made more than $200,000 a year, according to an August, 2022 Freedom of Information request from a Nassau resident and answered by NIFA. Presumably, there were cost of living increases since then:

Evan Cohen, Executive Director $218,329.

Conal Denion, Deputy General Counsel $180,000.

Carl Dreyer, Treasurer $156,074.

Kathleen Stella, Corporate Secretary $ 76,870.

Jeremy Wise, General Counsel $217,067.

Martha Worsham, Deputy Director $141,440.

But NIFA will stick around as an oversight board even if it gives up financial control. NIFA continues to exist until all debt borrowed by NIFA on behalf of the county is paid off.

Voters tolerate it They seem to

ReplyDeleteBe happy with unelected political appointees running the show. Sounds like something out of Putins playbook