Odds and ends from Nassau casino hearing

|

| Sands Corp. rendering of its proposed Nassau Coliseum Casino development |

Nassau's 9-hour meeting Monday about the proposed transfer of the Nassau Coliseum lease to Las Vegas Sands for development of a casino in the county's HUB began with Legis. Kevan Abrahams, leader of the seven Democrats on the 19-member legislature, announcing that he was recusing himself from participating.

The Freeport Democrat said it pained him to step away but he had a conflict of interest.

|

| Kevan Abrahams |

"I was looking forward to participating and hearing from you," he said. But, he added, "Because the conflict is real and does pertain to family member I have been advised by counsel not to participate in debate or discussion or final vote."

He gave no details.

So let's see what he said in his required written recusal form

According to the legislative rules, a county officer must promptly recuse himself from any matter "in which he or she has any direct or indirect financial or any other private interest..."

It says the officer "shall be required to disclose such recusal in writing...and the nature of his or her private interest."

But Abrahams' submitted recusal doesn't shed much light on the matter, such as the nature of his or her private interest.

The lack of detail immediately raised political suspicions that Abrahams was trying to duck a controversial decision.But supporters point out that Abrahams faces no political consequences, no matter how he would have voted, because he is not running for re-election.

Apparently, his wife works for the Sloan Kettering Cancer Center, which is located in the HUB. No idea if the center opposes or supports a casino neighbor.

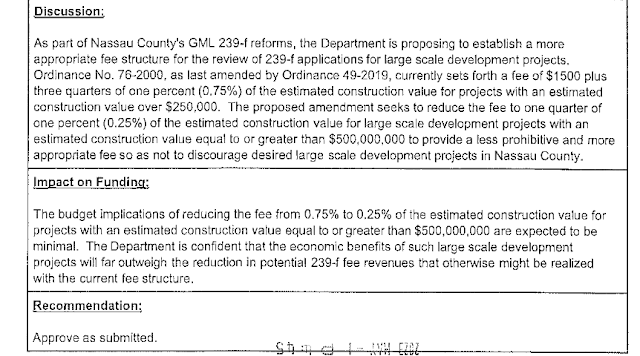

Also at Monday's meeting, Republicans on legislative committees granted a multi-million dollar building-fee break to the Casino.

Republicans who control the committees voted in favor of reducing by two-thirds state-authorized fees for the county public works department to review large-scale building plans:

Currently, the county charges a fee of $1,500 plus .75 percent of the construction cost for projects valued over $250,000. The new fee would be .25 percent of the estimated cost for projects of $500,000 or more.

Given that the casino's estimated cost is some $4 billion, that's a big break. But Las Vegas Sands will still shell out $8.75 million for review of the building plans. That's $8.75 million more than the county would get for reviewing no project.

Democrats abstained on the reduction, which goes to the full legislature along with the lease transfer, on May 22.

Then there was the presentation from Las Vegas Sands, which said that the company would turn over a $54 million non-refundable fee to the county as soon as the lease transfer is approved. Representatives continued to talk about the millions of dollars Las Vegas Sands would spend and the millions of dollars that would be generated by its proposed development of a casino, hotel-resort.

It was a vastly different presentation than given by former Islanders owner Charles Wang when he proposed the Lighthouse Coliseum project under former Democratic County Executive Thomas Suozzi in 2009.

Wang seemed particularly penny-pinching back then, putting as little of his own money as possible into the project while expecting initial commercial development of the 80-acre site to pay for the rest of the plan, including renovation of the Coliseum.

The Lighthouse never made it past Hempstead Town.

Yes, the Las Vegas Sands project could be pie-in-the-sky.

A Newsday editorial today acknowledges that it could be too good to be true. But the editorial also refers to the many, many terrible deals made by Nassau leaders over the year that have left the county essentially shouldering the cost of a decrepit Coliseum and empty parking lot.

It doesn't even mention John Spano, Nassau's 1996 version of fabulist Congressman George Santos.

Spano briefly "bought" the Islanders for $165 million and promised then County Executive Thomas Gulotta to develop a sports-entertainment center at the Coliseum.

But Spano was a fraudster who lied about his finances, background and businesses. Sound familiar? He ended up in federal prison.

According to Wikipedia, Newsday in 1997 "exposed Spano as a fraud who was not worth even a fraction of the money required to complete the Islanders deal. Among other things, the Newsday investigation revealed:

- He had grossly misrepresented his net worth; he was worth only $5 million.

- His Bison Group had 22 employees and assets of $3 million.

- He had lied about numerous items on his résumé. For instance, he had claimed to have graduated from an exclusive prep school in Ohio, but had actually graduated from a small Catholic school in Ashtabula.

- His "inherited wealth" did not exist; neither of his grandfathers had an estate valued at more than $246,000."

.jpg)

Comments

Post a Comment