Uh-Oh. Nassau depository bank fails. (With snarky update about Barney Frank)

It's probably too soon to panic.

But, the collapse of Silicon Valley Bank on Friday led many to wonder if there were going to be other bank failures despite federal authorities assuring everyone that the economy remains strong and the California bank's financial troubles were contained.

Today Signature Bank of New York was shut down by New York State regulators, the U.S. Treasury and FDIC announced.

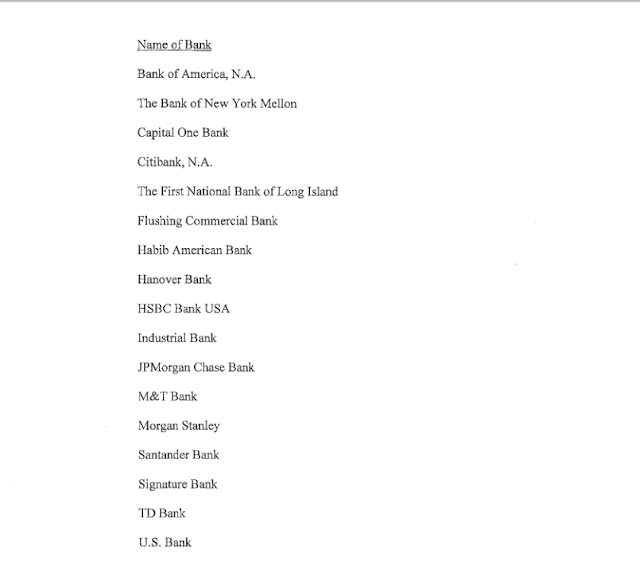

In October, the Nassau legislature approved a list of banks for deposit of county taxpayer funds. Yes, Signature was among them. (see below)

News reports say the feds will guarantee all deposits. But who will ultimately pay that guarantee?

Financial pundits say Signature has been under financial pressure for weeks.

Did Nassau treasurer move any money it may have had in Signature? Did the Comptroller flag it.

The county executive's spokesman did not respond to an inquiry about Nassau and Signature.

And where's NIFA? You know, the Nassau Interim Finance Authority, the state appointed financial control board that is supposed to be make sure Nassau is solvent.

Again, it's too soon to panic. But it may be time to worry.

Update: Snarky but couldn't resist:

President Joe Biden Monday morning assured worried Americans in a televised address that his administration was ensuring that the banking system is safe. He ended his remarks by saying, "During the Obama-Biden administration, we put in place tough requirements on banks, like the Silicon Valley bank and Signature Bank, including the Dodd-Frank law to make sure the crisis we saw in 2008 would not happen again."

Biden was referring to the banking regulation reforms sponsored by then U.S. Senator Chris Dodd and then U.S. Rep. Barney Frank.

Guess who is a member of the board of Signature Bank: Barney Frank.

Although Biden blamed the former administration of Donald Trump for weakening some of those regulations, Frank was right there to see that Signature followed them.

Biden also called for the firing of the management of the Silicon Valley and Signature banks. Does that include Frank?

Comments

Post a Comment