Nassau's resiliant economy continues to defy dire budget predictions

What a bummer for NIFA!

You know, the Nassau Interim Finance Authority, the state-appointed Democratic-run financial control board that wants to maintain its budgetary authority over Nassau's elected-Republican government.

Although NIFA continues to poor mouth Nassau's finances, the county's economy has proved more resilient than anyone expected.

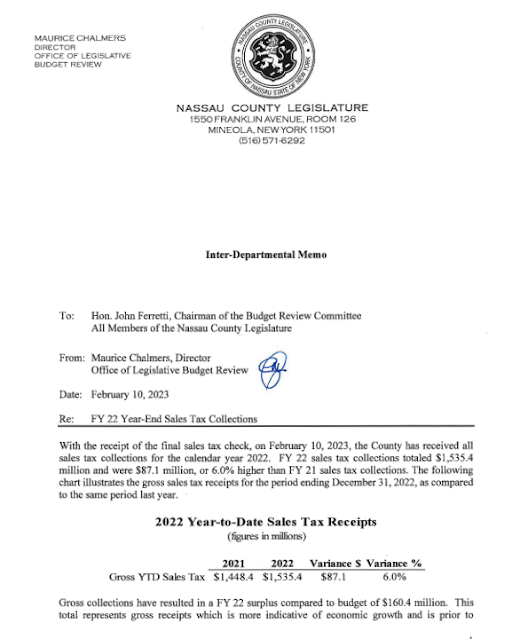

Earlier this month, the legislature's Office of Budget review reported that Nassau had received its final sales tax check from the state for last year. Collections totaled $1,545.4 million -- $160 million more than budgeted for sales tax revenue in 2022.

Sales tax collections are a key indicator for the state of the overall economy. They go up when its healthy; down when its sickly.

Last year's rosy results comes despite a cut in gasoline sales taxes -- proposed by Nassau Democrats when pump prices soared early last year -- on all sales over $3 a gallon.

Budget Review reports that total sales tax collections in 2022 are 6 percent above 2021 revenues and already exceed the 2023 budget projection by $8.1 million.

That's bad news for NIFA, which insists it must continue the control period it imposed in 2011, which gives it authority to accept or reject county spending.

But NIFA can only legally maintain financial controls if there is a operating budget deficit of one percent.

Unfortunately for NIFA but good for the county: Nassau has ended with a budget surpluses for the three years prior to 2022.

Nobody yet knows the total budget year-end results for 2022, but a $160 million surplus in sales tax revenues likely means the county ended in the black again last year.

NIFA continues to insist that Nassau's financial outlook is so grim that it needs to maintain controls.

Last August, it predicted that sales taxes in 2022 would exceed the county budget by $86.8 million -- about half the actual results though there was some quibbling over required offsets. It didn't mention that one of the offsets is NIfA operating costs, which are taken off the top of all county sales tax collections.

"Our cautious outlook stems from concerns that the pronounced growth in sales tax revenue experienced over the past 15 months is not sustainable. In fact, some sources have reported that high inflation and rising interest rates are leading to a slowdown in economic growth and consumer spending," it said last August.

It also direly forecast that Nassau will end this year with a deficit of at least $12.9 million but as much as $39.3 million-- just enough to allow the Democrat-appointed board to remain in control of the Republican-elected government's finances.

One financial question mark should be answered this evening when NIFA is expected to consider approving a new contract for Nassau's Police Benevolent Association, which has been working without a signed accord since the end of 2017. The new deal is supposed to comply with NIFA spending guidelines. (Update: Newsday reports NIFA approved the contract)

That leaves only the Corrections Officers Benevolent Association and the Civil Service Employees Assocation still without current contracts.

Still, even the non-partisan budget review office is cautious.

"There appear to be competing forces in the economy, on one side there is an overwhelming risk of

a recession, but consumers seem to be sustaining high levels of spending. Nassau County sales

tax receipts have been strong, surpassing economic forecasts. However, this continued level of

spending may not be sustainable in the long run," it said.

Comments

Post a Comment