Politics at play with Nassau's fiscal watchdogs

Everything is political in Nassau County government, even its fiscal watchdogs.

Just look at their October reports about Republican County Executive Bruce Blakeman's proposed $3.3 billion budget for next year: The first came from Republican elected County Comptroller Elaine Phillips; the latest from the Nassau Interim Finance Authority, a state appointed board composed of mostly Democrats and Democratic contributors.

|

| Elaine Phillips |

She projects a $60.4 million surplus by the end of 2023. Then, for the next three years, she sees nothing but surpluses: About $3 million each year for 2024 through 2026 if Blakeman does nothing more; But if he takes promised financial steps, she projects annual surpluses as large as $110 million.

For NIFA, which took control of the county's finances in 2011, Blakeman's 2023 budget is all gloom and doom. And so are the three years after that.

Adam Barsky

For 2023, NIFA, chaired by former Gov. Andrew Cuomo appointee Adam Barsky, predicts a deficit of at least $12.9 million but as much as $39.3 million if recession hits hard. It sees deficits as high as $241 million over the next three years.

Although NIFA acknowledged this summer that the county will end 2022 with a $61.5 million surplus -- the county's fourth consecutive year of budget surpluses --it's high-end deficit projection for 2023 would be just enough to allow the Democrat-appointed board to remain in control of the Republican-elected government's finances.

State law allows NIFA to take financial control, as opposed to acting as a fiscal oversight board, if there is a deficit of one percent or more in the county's major operating funds.

The proposed 2023 budget is $3.3 billion; If you add in intrafund transfers (which is essentially double-counts the amounts being transferred) it comes to $3.8 billion. NIFA's deficit projection? Just over $39 million. What a coincidence.

As NIFA's report points out, "These amounts exceed the one percent threshold for imposing a control period."

But what does a third watchdog -- the Legislature's Office of Budget Review -- predict for 2023?

The non-partisan office -- which answers to both the Republican majority and Democratic minority on the county legislature -- evades the answer by projecting no specific surplus or deficit for 2023 while calling the out-years "challenging."

OLBR only suggests a surplus by calling it an "opportunity":

"OLBR has preliminarily identified approximately $79.5 million of risks in the Proposed FY 23 Budget for the Major Funds which are offset by $84.9 million in opportunities for a net opportunity of $5.5 million."

Blakeman currently is floating in surpluses, some from leftover Federal Coronavirus Cares Act money, but mostly from excess sales tax collections and debt service savings.

NIFA and former Democratic County Executive Laura Curran's budget office severely underestimated sales tax collections during the pandemic.

The dire warnings about sales tax deficits helped NIFA convince the legislature to approve refinancing an astounding $1.1 billion in outstanding debt last year. NIFA broke with its past practices and front-loaded the savings, providing Democratic Curran with a cash cushion of more than $435 million in savings over the next two years.

All this money was deposited in Nassau accounts just in time for Curran's re-election bid last year.

But Curran made the mistake of losing the election. Now NIFA has to deal with Blakeman, who is wielding some $440 million in reserves..

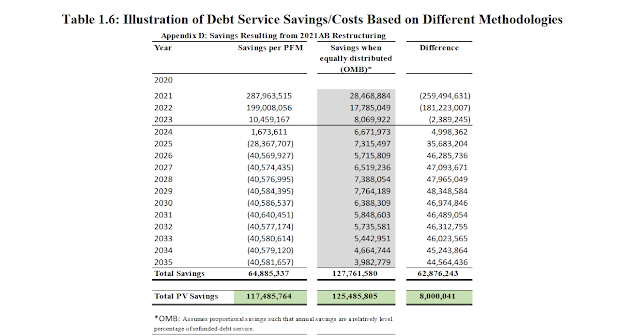

A chart provided by the budget office shows that the refinancing saved Nassau some $64 million while extending the county's debt another 25 years.

But it also shows that the county could have saved more than $127 million if NIFA hadn't front-loaded the debt.

OLBR explains, "When NIFA completed the refinancing/restructuring of outstanding debt, it focused on maximizing the savings in the earlier years with the cost being pushed to the out-years. This was a policy decision which was viewed as providing the county great cash flexibility in the first three years to handle the fallout from the Coronavirus pandemic. However, this will eventually place a heavy burden on county finances in future years. In the past, the Control Board required that savings be equally distributed during the term of the borrowing and would not allow front-loading of the savings. However this was seen as extenuating circumstances. To understand the impact of that decision, OLBR asked OMB to run the hypothetical scenario with the savings being equally distributed."

So front-loading savings in early years means higher costs in later years.

It also means that NIFA, even if it gives up financial control, will be around til 2051 to oversee the debt it sold.

As NIFA points out, " Even after the termination of the Control Period, NIFA would still not be statutorily dissolved until 2051. NIFA could still reimpose a Control Period if the County’s fiscal

condition were to deteriorate and there were insufficient revenues or reserves to cover any

shortfalls."

Blakeman, Phillips and the Republican legislative majority all have called for NIFA to end its financial control because of the four years of budget surpluses.

But nobody has done anything to force NIFA's hand.

Maybe it's because three major county unions have unresolved contracts. The Police Benevolent Association, the Corrections Officers Benevolent Association and the Civil Service Employees Associations have been working without contracts since the end of 2017.

Maybe its easier for Republicans in charge of Nassau government to blame NIFA for demanding contract concessions rather than refusing union demands themselves.

See, everything is political in Nassau.

Comments

Post a Comment