Judge: Nassau reassessment settlement can't be used against taxpayers

|

| Nassau Supreme Court Justice Stephen Bucaria, from NYcourts.gov |

A more than year-old lawsuit challenging Nassau's reassessment as arbitrary, secretive and unconstitutional was almost settled today. Almost.

Nassau Supreme Court Justice Stephen Bucaria told lawyers during a court hearing in Mineola that he was ready to sign an order settling the lawsuit if both sides made clear that he wasn't deciding the fairness, accuracy or constitutionality of Nassau County Executive Laura Curran's 2018 reassessment.

And, he emphasized, the settlement would have to say in bold that it cannot be used by the county to fight taxpayers who claim their assessments are unfair.

"I want the average layman, the average taxpayer in Nassau County to know it can't be used against them," Bucaria told lawyers for both sides.

That left a settlement that essentially calls for the county to be more transparent about its assessment practices in the future.

But a question of legal fees held up the deal until at least next week.

The case began in April 2019 when Sands Point homeowner Eric Berliner and three other Nassau residents challenged the legality of the reassessment.

In January, Bucaria approved class action status for the suit, noting that 236,000 of the 386,000 residential property owners in Nassau had filed assessment grievances against the new values. He set a trial schedule that was completely disrupted by the coronavirus pandemic and subsequent court shutdown in March.

Earlier this month, the four homeowners reached the tentative settlement with Nassau. Both sides asked for the class to be decertified and they wanted Bucaria to declare the reassessment "fair, accurate and reliable." Lawyers disagreed whether the deal also included guaranteed assessment reductions for the four plaintiffs.

But Bucaria balked at characterizing the reassessment.

In addition, tax appeal lawyers and County legislator Steve Rhoads (R-Bellmore) raised red flags, saying they were worried the settlement would jeopardize grievances filed by residential homeowners who may not even know they were protected members of a class.

Faced with these issues, county lawmakers earlier this month held up approval of a contract for the Manhattan law firm defending the county, Wolf, Haldenstein, Adler Freeman & Herz, LLP.

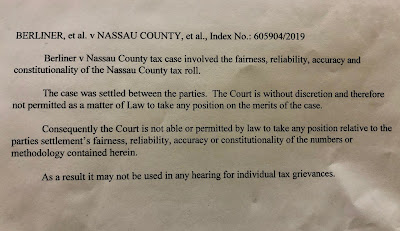

Bucaria at the start of today's hearing read a statement that he said he wanted the lawyers to translate into layman's terms as part of the settlement:

"Berliner v Nassau County tax case involved the fairness, reliability, accuracy and constitutionality of the Nassau County tax roll," Bucaria began.

"The case was settled between parties. The Court is without discretion and therefore not permitted as a matter of law to take any position on the merits of the case.

"Consequently the Court is not able or permitted by law to take any position relative to the parties settlement's fairness, reliability, accuracy or constitutionality of the numbers or methodology contained here in.

"As a result it may not be used in any hearing for individual tax grievances," Bucaria concluded.

Rhoads today applauded Bucaria's direction. "Today is a victory for taxpayers," he said, contending the original settlement was "a thinly-veiled attempt to use the Court to stack the deck against taxpayers exercising their right to fight for fairness."

After lawyers today agreed to follow Bucaria's direction, the question of legal fees came up.The homeowner's lawyer had asked the judge to order the county to pay more than $900,000. Nassau objected.

Bucaria said he thought both sides had agreed to a fee. Since there is a dispute, he directed both sides to put in their arguments next week and said he will wait until then to order the settlement.

"I didn’t know the issue of the fee is still open," Bucaria said. "I won't sign this piecemeal."

|

| Bucaria settlement statement |

Comments

Post a Comment